This is a problem because what you really want is to trade price action. If you focus on finding moving average bounces, you will end up trading the moving average. To mitigate this problem, let’s set a few ground rules.įirst, forget about using the moving averages as support and resistance. Golden Cross Framework Price Action Guidelinesįor a price action trader, there is a common problem when it comes to using moving averages. Do not rely entirely on the Golden Cross signals Ībove all, consistency is vital for ensuring that you get used to interpreting one type of moving average.Perform sound price action analysis and.Nonetheless, in practice, as long as you:

200 ema strategy pdf plus#

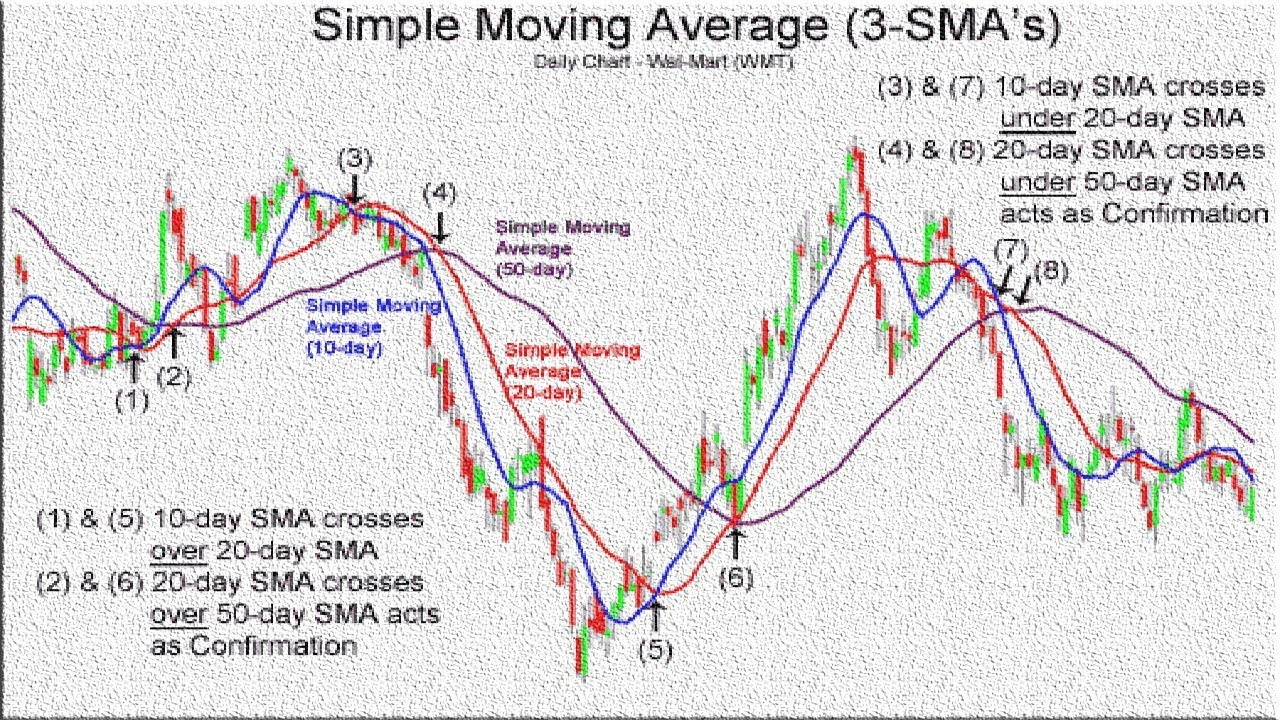

Hence, responsiveness to recent price action is not a plus for us. We are not looking to trade the Golden Cross signals. Hence, we will be using the SMA in this tutorial.Īfter all, we want to set up the Golden Cross as a framework for macro analysis. In fact, if the moving averages are too responsive to short term prices, it may be harder to interpret the long term bias. Hence, the responsiveness of the moving average is not critical. However, here, we aim to focus on the more stable signals for macro analysis. And for many applications, they are right to do that. Some traders gravitate towards the EMA because it is more responsive to price action. And others might use exponential moving averages (EMA). Should You Use SMA or EMA For The Golden Cross?įor the Golden Cross, you will see some traders using simple moving averages (SMA). The interaction between the two moving averages offers meaningful analysis.The Golden Cross is grounded by long term price action.They ensure two critical behaviors that contribute to useful market analysis. 200 will not work well.)įor a valid Golden Cross approach, these two principles are essential. There must be a substantial difference between the two moving averages.(Avoid short-term moving averages that tend to be very responsive to price changes.) Both moving averages must be distant from the effects of short-term price action.However, for our purpose, two principles must apply:

The parameters are not cast in stone so you can vary them. The Golden Cross shown in the chart above worked well as a buy signal.īut as you will see, a price action trader should focus less on using the Golden Cross as a buy signal. (i.e., when the 50-period moving average crosses above the 200-period moving average.) The Golden Cross is simply the bullish crossover of these two moving averages. The prevailing lookback period for the moving averages are 50-period and 200-period. The basic setup of the Golden Cross combines two moving averages: It is an easy idea to grasp, and here is a short primer. If this is the first time you hear about the Golden Cross, don’t fret.

But the principles discussed apply to the Death Cross as well. Note: This tutorial focuses on the Golden Cross for simplicity. Read on, and you’ll learn what this means. In our approach, we are discarding the Golden Cross signal in favor of a Golden Cross framework.

200 ema strategy pdf how to#

In this tutorial, you’ll learn how to exploit the Golden Cross setup for price action trading. While these names sound melodramatic, they do offer substantial value for sensible traders. Its bearish counterpart has an equally gripping label: Death Cross. The Golden Cross is a prominent moving average signal that both technical and fundamental analysts are familiar with.

0 kommentar(er)

0 kommentar(er)